There have been numerous dangerous weather-related emergencies over the years. Why not be prepared in case you need to leave your home quickly? This week, we'll discuss how to create a comprehensive bank account list for your preparedness binder (affiliate). A bank account list is where you would store a variety of information. This can be digital or in paper, like the one I shared below. But, you may be asking, "Why do I need to do this?"

Jump to:

Why do I need to create a complete bank account list?

- This list will help you in emergencies. It will give you one place to go to get information you may need when you need it most.

- It will help your family when you pass. If you pass away and haven't had a chance to discuss your finances with your family, this will help them find the information they need to pay your bills and manage other financial tasks.

- It will help you see all your financial contact information in one place. Having all your contacts in one place, related to your accounts, will make it easy for others to know who to contact for particular accounts.

If you are like me, you probably use software like Quicken to track and reconcile your bank and financial accounts. That's great, but did you fill out the detailed information that would include contact information for each account? Not many people fill in this information; they figure they have it in their contacts in their address book. But remember, you probably don't have the account number for every account you own memorized. So, having one place to store this basic information will help. Storing the account number in your financial management software with your contacts will help yourself and others get to the right person.

The entire package to help you with hackers, viruses, malware, and ransomware provides up to $1M in potential coverage and so much more! *Note: rate is $47% off the first year! $189.99 / year. Protection for 10 PCs, Macs, Tablets, or Smartphones.

Now, it's time to make your bank account list.

First, determine a place to add this information.

Where to add the bank account information in Quicken?

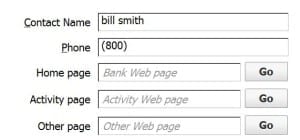

The steps are below on where to put your contact and account number information.

- Go into one of your bank accounts.

- There is a gear on the upper right-hand corner of your account register.

- Press the gear button, there will be a drop-down list, select "Edit Account Details".

- A window will pop-up and you can edit the Contact Name and Phone number section easily. Add the account number if it is missing too.

- Be sure to save it when you are done.

NOTE: You will need to do this with all your financial accounts.

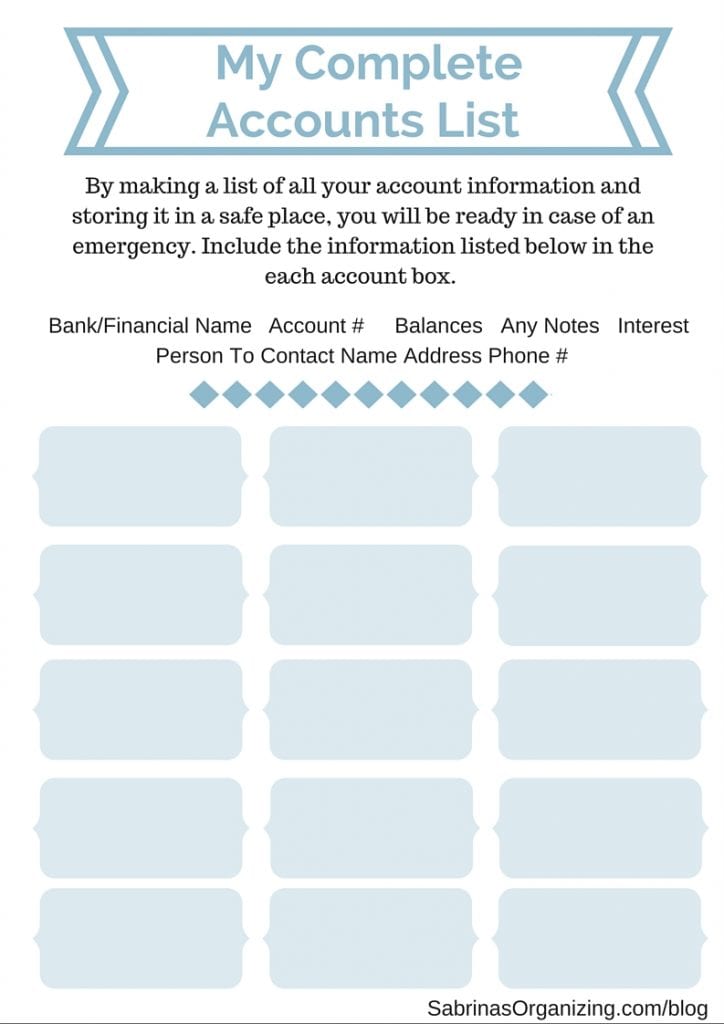

Create a printable to track this information

If you don't use software to track this information, I created this free printable for you to use. Be sure to add all important items, such as bank account name, account number, balance, and any notes that others need to know. If you're interested in the account, add that too. Also, add the contact person and their contact information (address/email/phone number). You can also add this information to a spreadsheet file, like Microsoft Excel or Google Sheets.

Additional information can be stored in other places.

You can also store this in your password management app. Just be sure that you have a family plan so your family can access the accounts. Also, you will need to select a designated person to have access to your account when you pass. Consider password management apps like LastPass, which offer a secure bank section for storing all your information.

Next step

After you have completed this task, find a safe (affiliate) and secure place to store it. It can be in a safe (affiliate) In your home or a safe (affiliate) deposit box.

If you have a safe (affiliate) deposit box, be sure there is, at least, one other person able to access this account.

This task will take some time to gather so that is all you have to do this month. Take your time and complete as much of the bank account information this month as you can. Making a note of different questions or tasks you need to do to gather the information will help you stay on track.

Do you have a list of accounts and their contact information, readily available? Where do you like to store this information? Is your information digital or paper? Please join the conversation and leave a comment below.

Visit these sites for more information about Emergency Preparedness.

Looking for more tips, visit our other Emergency Preparedness posts.

Nicole Ramer says

My husband wouldn't know how to pay our bills if something happened to me... I definitely need to complete this challenge! Thank you, Sabrina!

Sarah Soboleski says

Great, practical advice, Sabrina! Good reminder!

Linda Samuels says

Preparing for emergencies, or even knowing that all your important info is in one place can help us sleep better at night. A good thing to do. My husband worked on this project for us (thank you, Steve!) Of course once it's done, we have to update it every so often.

Recently I needed to look something up and it was so helpful having the info that he had pulled together.

Sabrina says

That's great, Linda! It's so important. I use ours all the time.

Jill Robson says

I have a list of things on Evernote, but I do need to put in more information than what is already there. Thank you for the reminder, very important.

Sabrina says

It really helps me manage my post topics and plan for future posts.

Janet Barclay says

Yikes! I do not have all this information in one place. Yet.

April Reis says

I keep a list of all bank information, as well as credit card numbers & phone numbers, and all account log-ins and passwords on an Excel spreadsheet. Easy to update, and printable to keep in my master files for my husband to find in an emergency.

Sabrina says

Great job, April. It's one of those things that people don't keep an eye as they are doing their life. Thanks for stopping by and commenting.