Do you know where all your accounts are? What accounts are open? What you owe? What you have? Not everyone does because they choose not to find out. Getting finances in order is so important. These tips will help take out the clutter from your finances to allow you to see the bigger picture of your overall net worth.

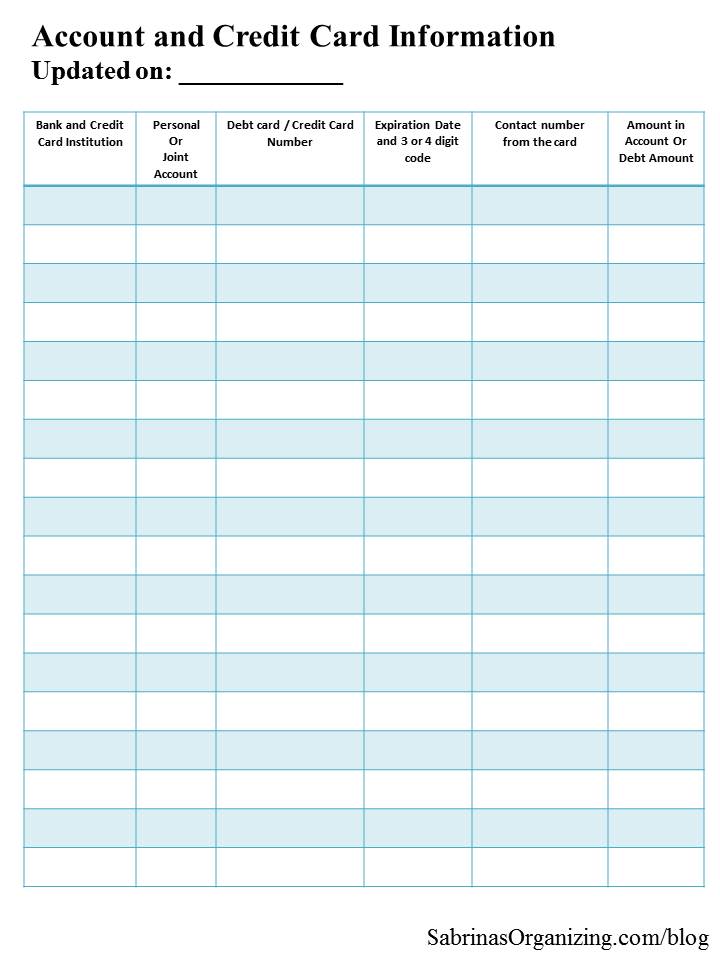

First, be realistic with yourself and your partner. It may be scary but, it needs to be done. Write down everything thing you own and all the accounts you have with the amount that is owed. I recommend Quicken if you are computer (affiliate) savvy and have the time to set it up. If not, a piece of paper will do just fine. You can use this sheet too if you want.

After you determine what your bills are, the next step is to go and find out how much you want to put down on the outstanding debt accounts. Tip: Always pay more than the "minimum". If you can't pay much, at least pay the minimum plus the interest from the previous month. Also, focus on the highest interest accounts first and then after you paid them off, work on the next highest interest accounts.

Then make the process easier: Go paperless!

- Setup an email account just for bills. Use this email account for your different bills.

- Download your bank statements and reconcile if you use Quicken.

To keep your paper bills in one place, have a monthly bill organizer binder.

- Have a place for those bills that are monthly or quarterly that do not have online access. If you have yearly bills, place those bills in the due date section or write on a post-it and stick it to the section of the binder.

Here is an example of one you can buy from Amazon (affiliate).

Use your bank's Bill Pay service.

- Usually it is free and you can save all your bills and addresses in the account. You can usually schedule reminder emails to keep you on top of the bills.

- When you receive the bills, log into bill pay and schedule them right away. Use the due date as the date you want the bill to be paid.

Find a system to help you remember when bills are due.

- After you save the bills that are recurring in Bill Pay, set up reminders to email you when ready to pay.

- Use Quicken or other bill management software to manage and create reminders for all bills are due, as well as, your investments.

Create a nest egg: Saving is important.

- SAVING FOR AN EVENT: Find out how much an item costs. Decide when you want to buy it. Determine how many months it will take and divide the cost by the total months. Then, save that amount each month till you have the funds to buy it. If you can't do the entire amount each month, be flexible.

- GENERAL SAVING: Start out small with general savings. I recommend $50.00 a month or $100.00 per month. That only comes down to $1.70 per day for 30 days or $3.34 per day for 30 days. Remember: This money is not intended to be spent. It is your savings. You should have at least 6 months savings for emergencies. So, don't spend it. Pretend it isn't there.

- RETIREMENT SAVINGS: Rollover your 401k into one account instead of having several 401K accounts. This way you can manage them all from one account.

By taking the clutter out of your finances, you will be able to help yourself and your family be more in control of your life. I hope this helps inspire you to get your finances in order and manageable. If you need help, contact a professional to assist you.

Leave a Reply