There is a new challenge many people plan to take on this year. It is called the No Buy challenge. This post will explain this challenge and why you may want to do it. Here are some tips for making your No Buy challenge.

Jump to:

- My Story

- What is the No Buy Challenge?

- Benefits of Doing the No Buy Challenge

- How long should I do my no buy challenge?

- No Buy Challenge Rules

- Determine Your Why When Doing This Challenge.

- No Buy Challenge Examples

- What CAN I buy on the No Buy Challenge?

- Tips while doing the No Buy Challenge

- No Buy Challenge Sheet Example

My Story

When I started living with my husband, I found that we would both constantly spend money almost daily. And, boy, our spending habits were out of control. We got into credit card debt within a few years, just to get the house furnished and go on vacations. Then we realized we needed to stop spending because we started thinking about having kids and wanted to start without any credit card debt, since we knew the kids would add to it.

As we worked to pay down our debt, it took us about 3 years to pay off the highest-interest credit card first, then roll the money spent on the paid-off credit card to the next-highest-interest credit card. We used the avalanche method. It was a conscious effort, but we made it happen. To do this, we needed to stop spending. And, just by taking the time to do this, we made a huge difference in our savings by reducing our spending. So, when I heard of this No Buy Challenge, I thought it would be a great motivation to share during the beginning of the year.

This challenge is intended to help people save money and reduce unnecessary spending.

What is the No Buy Challenge?

A No Buy Challenge helps you control your spending by stopping the purchase of items you don't need and instead saving money for goals you may want to achieve.

Benefits of Doing the No Buy Challenge

The main benefit of doing this type of challenge is that you can create your own limitations and goals. Creating your limitations gives you control over your finances. You are deciding to do something to change your savings. That is super powerful! You are powerful and disciplined!

You can start saving for retirement with the excess money you have. This will make your older self say thank you for beginning this when you are young.

Another benefit of doing this is that it allows you to develop new skills rather than waste money. Instead of spending money on unnecessary items, you may learn a new skill for work.

And another benefit is that you can reduce your carbon footprint simply by buying fewer things.

You will also spend less time shopping, cleaning, and enjoying your life more with less stuff. It will be a lifestyle adjustment, but it can be done.

The benefits you may find while doing the no-buy challenge are genuinely endless.

How long should I do my no buy challenge?

Your no-buy challenge can last a few months to a full year, or however long it takes to achieve your goal.

To determine how much money you will need, divide the amount by the timeline you'd need it to cover to get a monthly savings number. Then, you can subtract the savings number from your budget and allocate the remaining inflow of funds to your approved do-buy items.

Or, you can just say you want to save a certain amount of money each month and figure out what items you need to cut back or stop buying to reach your monthly savings amount.

No Buy Challenge Rules

The rules for the No Buy challenge are simple, flexible, and can be any length you want them to be, depending on how much savings you want to make.

Start by creating rules for your spending. You can include a list of things you are allowed to spend money on and things you will stop spending money on. Below are some examples of No Buy Challenge Items.

Determine Your Why When Doing This Challenge.

You need to know why you want to do this challenge. This will keep you focused and prevent overspending. For me, we knew we wanted to be debt-free before we had children. Some reasons for you may be to save money for holiday shopping, save for a down payment on a house, or save for a new car. Write your why on paper and post it somewhere to remind you why you are not spending each morning.

No Buy Challenge Examples

Maybe you want to save money on your streaming app subscriptions. Instead of having all of them, you decide to limit yourself to only 3 of them.

You can also say you do not want to spend money on new clothes or shoes (affiliate) for the next three months.

If you spend a lot of money on home decor, you may not want to buy home decor for 6 months.

Another no buy year challenge could be to use up all the food in your pantry (affiliate) before rebuying food. If you have a lot, you may not shop for a month.

Another challenge could be reducing your going-out-to-eat budget or social outings to increase your savings; you can create a no-buy challenge for no food from restaurants.

Want to get rid of the excess makeup or hair products you purchased? You may want your no-buy challenge to be don't buy makeup or hair products for at least 1 year.

You can create a no-buy coffee-and-snacks challenge to save money and stop buying to-go coffees or snacks.

Another access item you may want to cut back are books. If you have a lot of books but haven't finished reading them, you may want to do a no-buy books challenge. You can aim to read at least 10 books before buying a new one for an extra challenge layer.

The last example of something you may want to do during this no-buy challenge is spend less on concerts or movies. You may want to do a no-buy challenge to give yourself time to save money for these events.

Above all else, consider your excess spending and pick the items that will help increase your savings/financial goal.

What CAN I buy on the No Buy Challenge?

Now, it's time to take a close look at what you can buy. Make a list of these items you can buy so they are not as restrictive. Some examples to add to this list are groceries, paying bills, paying rent/mortgage, car loan, utilities, refilling or replacing toiletries, and personal items. These items should have a budgeted amount (visit my FREE ebook about home management, where I share how to do a budget).

Tips while doing the No Buy Challenge

Below are some tips when making your no-buy challenge. Do the no buy items first, then set the list aside and revisit it another day. Review it and decide if there is anything else you want to add or remove. Then, share it with a family member who will be honest and supportive of your wanting to change to see what they think. Try to have your no-buy challenge items reduced to three items.

Another tip is to not be too restrictive in your not spending. You do not need to punish yourself to achieve a goal. It will make it more challenging, and harder goals will likely be unachievable.

Another tip is to reduce your emails from online stores; they will tempt you into buying, so unsubscribe now before you start the challenge.

Be aware of everything you spend. This will help keep you on track, at least initially. Eventually, you will understand how much you can pay to have still money to save.

Suppose an emergency arises while in your no-buy month, so it's okay to focus your savings on that month. Things happen, and neglecting the unexpected expenses will worsen things later.

I hope these tips help you stay on target with your savings and help you create a customized sheet for yourself. If you need help making your goals and no-buy list, feel free to contact me. I can help you be accountable for your goals.

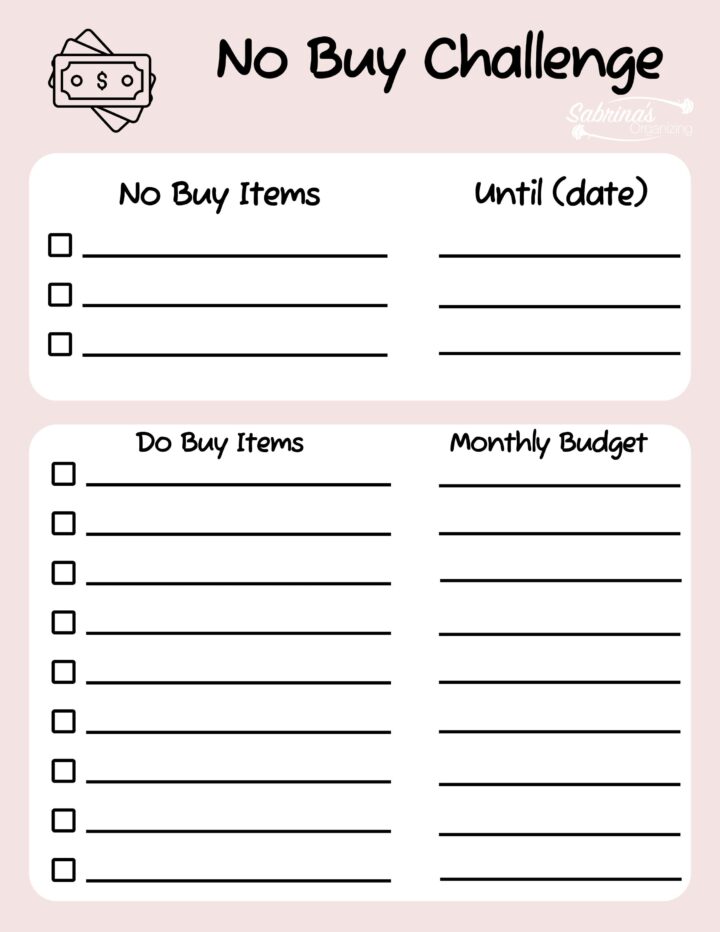

No Buy Challenge Sheet Example

To help you create your no-buy sheet, I created a form below to guide you on what to include. It's essential to include your do-buy items and how much you want to spend for each of them money. Spend time tracking these items for one month to have a realistic number for each do-buy item.

I hope this post inspires you to take on the no-buy challenge. If you embark on this journey, please comment below and let me know your no-buy items and your goal. Happy saving!

Below are some websites you may want to visit to save money.

- Rebecca Sowden blog - Do something nice for your future self.

- 10 tips from experts to help you change your relationship with money in 2025

- Expert Advice: How To Actually Reach the Financial Goals You Set on January 1

- Nourishing Minimalism - The No Buy Year: Spend and Save Meaningfully in 2025

- The Complete Guide To Your Best No Spend Month

- Could you live without shopping for a year? Try the 'no-buy challenge.'

Check out my other money-saving posts!