A common question is, "How long should I keep my tax records (paperwork)?" While each person's situation is different, these tips will help you decide what you can get rid of. Read on to figure out your position.

Jump to:

- How long should I keep tax records?

- Make sure you know your tax situation.

- Keep backup paperwork that would relate to your exact tax situation.

- Keep bank statements with your tax return paperwork.

- Utility Bills

- Keep your long-term stored paperwork safe.

- Shred any unwanted tax paperwork and statements.

- Don’t forget to keep credit card statements.

- Keep paycheck stubs for one year or until you receive and verify your pay stuff details.

- Store all the tax items in one accordion folder each year.

- How do you make a personal tax record supporting paperwork accordion folder?

I would always side with the more conservative number of years when keeping my tax paperwork, usually seven years. While I would keep them for seven years, reducing the unnecessary paperwork you filed away was helpful around the third year. This task would allow me to fit at least two years in one bin. It would significantly reduce my amount of square footage of long-term storage.

How long should I keep tax records?

The IRS says three years if you have not been audited. Below are other tips for organizing your tax paperwork and supporting documents. Visit my other posts I liked to this post for deeper, detailed steps.

Make sure you know your tax situation.

When a person gets audited, they are more likely to get reviewed again. So, keeping your paperwork for the 7 years may be a better choice to ensure you have everything.

Keep backup paperwork that would relate to your exact tax situation.

If you own a rental property or a small business, keep all your paperwork, such as receipts, canceled checks, tax returns, payroll or subcontractor paperwork, bank statements, and liability taxes paid reports/cleared checks.

Keep bank statements with your tax return paperwork.

If you have a bank statement with many charities, mortgage payments, and home improvements, you should keep them more for reference than for audits. Check images are usually in statements now, so you don’t need to keep your actual checks if you don’t want to.

Utility Bills

If you do not own a business or deduct a home office, only keep your utility bills until you have reviewed your bank statement and the charge has cleared.

But, if you are a business owner or deduct a home office, you should keep all your utility bills as supporting documents for your tax return.

Keep your long-term stored paperwork safe.

Find a place where you can save all your documents. Clear plastic bins (affiliate) with tight lids work nicely. If you want, you can place it in a fireproof safe (affiliate). If you don’t feel it is necessary, get a fireproof safe (affiliate) for your long-term paperwork and receipts from items you purchased for your home. This tip will be helpful if you ever need to claim items for your home with your insurance company.

Visit our post: 20 Personal Important Documents to Keep Safe for the list of paperwork to know what these papers are and how to organize them.

Shred any unwanted tax paperwork and statements.

To protect yourself from identity theft, ensure all papers, even those that only have your address on them, are shredded and disposed of properly. A cross-sectional shredder (affiliate) is best so no one can read the ink easily. This type of shredder (affiliate) does two different cuts when you feed the paperwork into it. Make sure the papers look like confetti when you are finished. Visit our updated yearly shredder events in the Southeastern PA area.

Don’t forget to keep credit card statements.

Keep your original receipts until you get your statement each month, then shred them if they are all reconciled. If there are any tax-related charges on the statement, keep the statement and receipt for three or seven years. Learn how to keep your digital statements and receipts on our post: HOW TO ORGANIZE DIGITAL RECEIPTS IN YOUR HOME

Keep paycheck stubs for one year or until you receive and verify your pay stuff details.

When you receive your W-2, make sure your last pay stub for the year matches with the W-2. If it does, you can get rid of all the pay stubs. If it doesn't, contact your employer and keep the last pay stub until the error is corrected. Shred all the other pay stubs for that year.

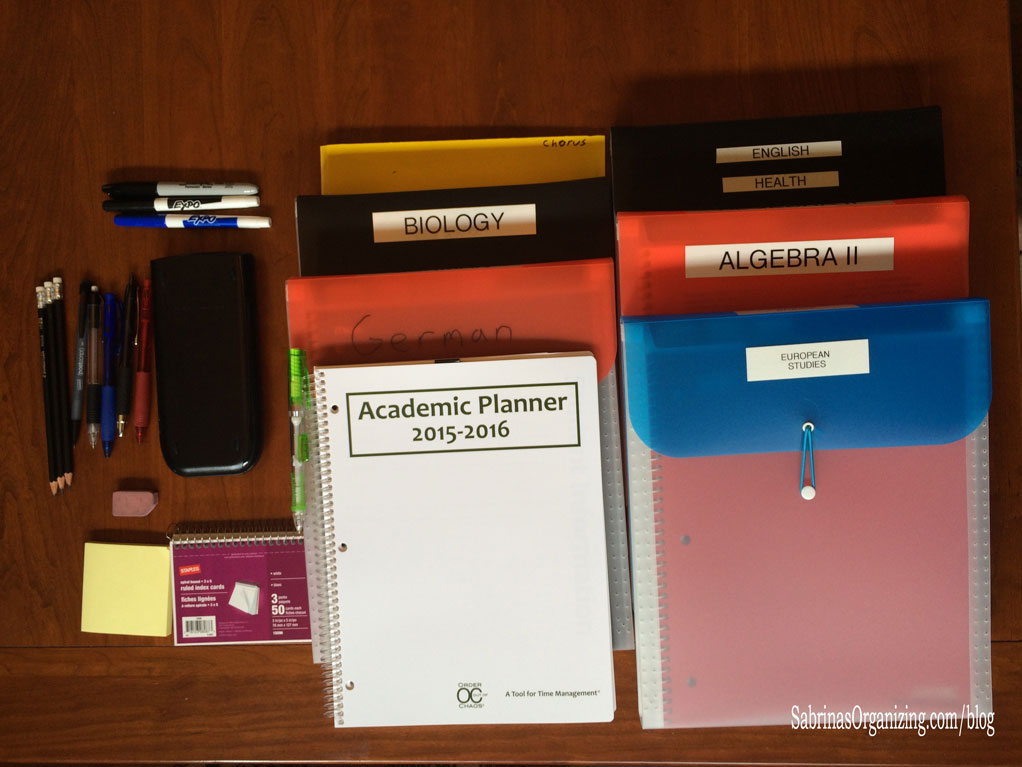

Store all the tax items in one accordion folder each year.

Keeping all my business files in one 13-tab accordion folder (affiliate) allows me to pull them out when I need them without losing anything. If you don’t have a business, you can create an accordion folder (affiliate) that holds all your supporting paperwork.

Here are the tabs (affiliate) we use to create our household's supporting tax paperwork accordion folder (affiliate).

First, you need one 13-tab accordion folder (affiliate) with a covered affixed lid. Something like these you can buy on Amazon (affiliate) (affiliate).

Accordion File Organizer, 13 Pockets File Folders, Letter Size with Colored Tabs

Buy Now →

Accordion File Organizer, 13 Pockets File Folders, Letter Size

Buy Now →(affiliate)

Visit our other paper management posts!

How do you make a personal tax record supporting paperwork accordion folder?

Then, add these tabs (affiliate) below.

Quicken or QuickBooks Tax Summary – whichever one you use is fine.

The first five income groups can be placed in one tab if you feel you are running out of tabs in your accordion folder.

- Income – W-2, 1099-misc, 1099-R – Add to this section any documentation statement you received from your employer, federal government, or contractors.

- Income – Bank interest – This one is usually not used often. If it applies to your situation, feel free to add it.

- An Income – Distribution – This tab is usually for people who get S.S. or other pension distributions.

- Income – Capital Gains – This section is perfect for the paid-out capital gains statements you received.

- An Income – Rental Property income and expenses – If you have rental property, you can split this one into two sections. One section is for income, and the second is for the property's costs. If you have several properties, create two sections for each property and add another accordion folder (affiliate). Accordion folders only have a maximum of 13 tabs (affiliate).

Deduction – Charitable deduction – cash and donated items – While I know this may all change this year if you still want to track your deductions, add a section for donations.

A Deduction – Medical Deduction – if you have any medical payouts, create a section to track them.

Deduction – Contribution to a 529 plan for the education fund. We can deduct some of our 529 contributions in PA, so I added this section to our accordion folder.

Deduction – Real estate taxes paid/ Mortgage interest paid/ Refinanced taxes paid – This section can be combined. It’s not necessary to separate them.

Have a tab for the final tax returns

Federal Tax Return – Have a section just for the copy of your official federal tax return that you sent out.

State Tax Return – Same for the state tax return. Create a section that includes a copy of everything you sent to the state.

Local Tax Return – If you have a local tax return, create a section with all the paperwork you sent to the local tax agency.

Keep in mind that accordion folders (affiliate) work great for small income tax returns and even people with small businesses. I like to have one for my business and one for our joint filing. These two accordion folders give me a way to review all my business separately from my personal.

Good luck with your paper purging process and setting up your new personal tax return supporting paperwork system. I hope it creates space in your home.

Want more information on when you should discard your papers?

Here are additional sites to help you. While the IRS site may seem very vague, it will give you a place to start determining what you want to do. After reviewing this information, contact your accountant and find out what they suggest.

How long should I keep records? This page is intended for self-employed individuals, but the IRS uses it when you type in "individuals, how long should I keep records."

Need more help organizing your tax records?

Visit these recent posts for even more tips and tricks when setting up a new tax records system.

Important Personal Documents to keep safe

4 Ways to Organize Incoming Paper Mail

7 Clutter-Free Ways to Manage Papers

14 Tips for Organizing Long-Term Files

Well, there you have it. This post will help you get inspired to rid yourself of tax papers and create a new, easy-to-manage process for future use. If you have specific questions about discarding your long-term tax records, contact a professional who knows your situation.

Please note these are affiliate links through Amazon (affiliate), and at no additional cost to you, I will earn affiliate fees if you decide to make a purchase.

Olive Wagar says

Thanks for the helpful & concise information. I think people let fear override logic with tax papers!! I like the idea to use accordion files--and it helps you be realistic about what you really need to keep. It gives clients a visual limit for their tax papers. I put my older returns in 9 x 12 envelopes taped shut...just in case the Smithsonian wants a sample!! I know it is completely unnecessary, but it doesn't take up that much space & It all fits in one drawer.

Janet Barclay says

I have to say that it felt really weird to get rid of business financial docs once I'd been in business for more than 7 years! It was tempting to keep it for historical reference, but one must be practical...

Melissa says

Love reading more on this topic! I'm trying to help my clients organize their paperwork prior to filing this year. Great resources!

Seana Turner says

This is one of those topics that can make you feel a little sick to your stomach! I always suggest people keep the documents if they feel queasy, as there are some documents that should be kept indefinitely. Great tips here. I'm pretty glad I'm not an accountant!

Linda Samuels says

Oh, how I can relate to this post, Sabrina! One of my favorite things to do at the year end is to clear out the past year's receipts and statements to make room for the current year. With the exception of the actual tax returns, that our accountant suggested keeping indefinitely, the supporting documents he recommended keeping 7 years from the date of filing. As you mentioned, it's important to check with your accountant because everyone has a different tax situation. The other part of year-end clear out that I love is shredding the older group of papers. I love letting go of the papers that are no longer relevant. It's so cathartic.