It's never too soon to work on organizing your finances. Before you know it, the holidays are here, and it's the new year. So, to help you get more organized with your money, this post will break down the areas and tasks you need to go through to make your money work better. No more working paycheck to paycheck. I know, it doesn't sound fun. Well, it isn't, but it is necessary to work on these areas. To help you get started, here are some areas you should look at this month. I added some posts I wrote related to these areas. Feel free to click on them and read more.

Jump to:

- Review your Paying Bills System.

- Questions to ask yourself about your billing system:

- Review and write down how much you are saving.

- Answer these questions to figure out where you are saving money.

- Review your debt accounts and add them to a spreadsheet or money-management software.

- After you get all these debt accounts together, answer these questions:

- Go through your receipts (digital and/or physical).

- For Digital Receipts:

- For Physical Receipts:

- Gather all your important documents and credit cards.

- Closing Remarks

Review your Paying Bills System.

The first thing you need to do to start organizing your money is to review your process of paying bills. Start by making sure your billing process is easy and streamlined. If you have some of your bill paying process writing checks and the rest autopay, you can consider using your bill pay through your bank to send out checks instead of writing them.

Questions to ask yourself about your billing system:

Is the billing system streamlined?

Do you have a bill pay area? Is it organized?

Can you work on getting some more payments on auto-pay?

Do you like how your system is now?

Is the system in place duplicating processes? Are you duplicating tasks, and do you need to do that?

Below are some additional posts that will help you with this process:

Seven Money Management Tips to Make this Year the Best!

WHAT TO KEEP IN YOUR BILL PAYING STATION

Review and write down how much you are saving.

The next task to do to organize your money is the determine your savings. Visit the different accounts to find out where you are saving your money. This will include the auto transfers from your bank and the auto deposits from your paycheck or checking account. Also, check places like your 401K, Traditional IRA, or SEP-IRA.

Answer these questions to figure out where you are saving money.

How much liquid cash do I have right now? Liquid cash accounts are checking accounts, savings accounts, or money market accounts.

How much do I save for liquid cash?

What am I saving for Retirement, and is that enough for my age?

Am I saving money for future vacations or other activities?

Am I saving for a car or a new home? How much?

Review your debt accounts and add them to a spreadsheet or money-management software.

Now, it is time to gather all this information together in one place and determine your expenses to help you organize your money. Visit our recent posts about how to create a debt spreadsheet. In this section of our Home Maintenance ebook, you get a financial section that will help you become more aware of your debt and how to budget your money.

After you get all these debt accounts together, answer these questions:

Do you have too much debt?

How should you bring down your debt?

Where do you want to focus first?

Go through your receipts (digital and/or physical).

It is important to review where you store your digital and physical receipts for your personal and business use. The business and personal receipt storage areas must be separate for easier access at tax time.

Review the paper and digital files and ensure each receipt/paid bill is in the right location.

Visit our How to Make a HOW LONG TO KEEP TAX RECORDS AND HOW TO ORGANIZE THEM post to learn how to make a tax record accordion folder.

For Digital Receipts:

If you place all your digital receipts in a folder marked Current Year Receipts, you may find it difficult to find things unless you label (affiliate) each file name, the company name, and the month/year. Try labeling your digital receipts like this: "Verizon10-2023". Then, when you have an entire year of Verizon, you can easily see that you have all of them because each one will start with the name Verizon and end with the date and year. If you have a small business, visit our sister site, Sabrina's Admin Services, How to Make a Well-Organized Business Digital Receipt Organizer post.

For Physical Receipts:

Review your file folders (affiliate) for your receipts and ensure you only have the right receipts in the current year's files. Removing older receipts will make it easy to find what you need for the current year. If you want to learn more about how long to keep records, visit our post.

Usually, you can reuse the file folders (affiliate) by turning them inside out or relabeling them. Below are some of my favorite file folders (affiliate) you can buy on Amazon (affiliate) (affiliate).

Pendaflex Portable File Box with File Rails in black

Buy Now →

Globe-Weis Poly File Folder Pockets, Letter Size, Assorted Colors

Buy Now →(affiliate)

Have a small business? Visit The Best Practices for Digital and Physical Filing Systems post ebook to help you get your business files organized.

If you like color coding your files, visit our HOW TO USE A COLOR CODING SYSTEM TO ORGANIZE YOUR HOME OR OFFICE post for guidelines.

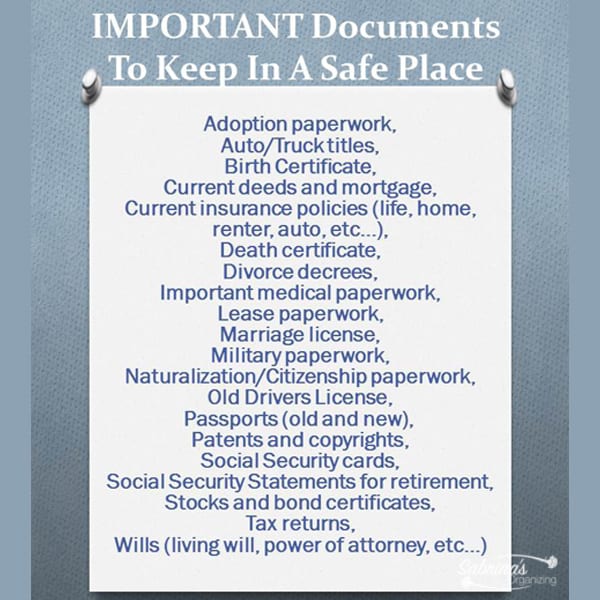

Gather all your important documents and credit cards.

The next area to organize your money is your credit cards, birth certificates, and social security cards. Any important document you have that you may need in the future. These items should all be in one or more fireproof safes. Visit my How to Organize Files in a Fireproof Safe for guidance on how to set this up. I also include a list of items that are considered important. Visit our Create a Reward and Credit Card Binder for tips on how to make this binder. Note not all safes will fit a binder, but you can add the inserts to organize the cards and place them in a hanging folder in the fireproof safe (affiliate).

Fireproof Document Box with Lock, File Organizer

Buy Now →

Fireproof Safe Box with Key Lock

Buy Now →(affiliate)

Important Documents like wills, insurance policies, house deeds, and car ownership papers are usually stored in filing cabinets, where they are likely to be found while reviewing receipts and paid bills. Pull them out of there and create an important document file in your fireproof safe (affiliate).

Closing Remarks

I hope these organize your money tips inspire you to get your money accounts organized. Now, get on with it and start this month! I recommend splitting the task over several weekends to not overwhelm yourself. Did I miss any areas? Please feel free to leave a message below.

Janet Schiesl says

Such great resources and an important topic. Thanks for sharing.

Julie Bestry says

All excellent tips. While I pay all of my bills online, I like to receive them on paper. This way, I read the confirmation code on the paper statement and everything goes into my files. Thus I have very few digital receipts, except those that come via email, which have their own filing system. Frustratingly, one credit card company does not create a confirmation code, so I end up printing, a screen capture and labeling in the manner that you suggest, although I would be more likely to put the year and then the date I paid it (like VERIZON-2022-10-18).

Diane N Quintana says

Great tips, Sabrina.

I like your labeling suggestion for digital receipts. I do almost all bill paying online and have been for a long time. I encourage my clients to do the same because it is easy, secure, and check fraud is on the rise.

Sabrina Quairoli says

Thanks, Diane! Thanks for stopping by and commenting. =)

Linda Samuels says

Such great suggestions for getting the finances and legal documents organized at this other level. My husband and I are fairly organized, but there's always more to do. We've prioritized getting things tightened up even more so this year and have been working together to see what needs updating or rethinking.

I handle bill paying, which I enjoy (and my husband doesn't.) It used to be all done by hand/paper. But over the years, I've switched to doing a combo of auto bill pay, paying online, and writing a few paper checks. I still like to have paper receipts, but after reading your section about digital receipts, I'm rethinking that too. It certainly would be better for the environment. In addition, my files would be thinner and I wouldn't have to shred as much. Something to consider.

Sabrina Quairoli says

That's wonderful, Linda! Thank you for sharing your process.

Seana Turner says

Lots of good tips here. We are moving increasingly to online bill paying, not because we really want to or because it is easier, but because mailing checks has become increasingly difficult. We've suffered theft in our area with people stealing right out of the mailbox with the flag up. Checks are "washed" and rewritten for more and then cashed. It's awful.

So, online we go. Thanks for the ideas here. Time invested on this topic is always well spent.

Sabrina Quairoli says

So sorry to hear about your area. That's awful. Good luck during your transition to online. If you feel you might forget the auto pays, I like to create a due date of bills list to help me remember when autopayments will happen.

Sarah Soboleski says

I like your tip on creating an important documents file for emergencies. It's always good to be prepared as you tend to not be thinking straight when disaster strikes.

Jill Robson says

I am the same as Janet, I keep a running total of what we really have in our account as apposed to what it says online.

Sabrina says

Thanks for sharing, Janet.

Autumn Leopold says

We must be on the same page Sabrina because my husband and I are doing this right now! I'm checking out MINT, YNAB (You Need a Budget, and Dave Ramsey has a new free software program I think. I'll let you know what we choose (probably in a blog post)! 🙂 One thing to add to what you said about reviewing your debt accounts. I always like to know the interest rates of the cards I use. We usually pay them off monthly but things happen and if you have an emergency you want to use the card with the lowest rate.

Sabrina says

Great suggestion, Autumn. Interest rates are so important to track to help eliminate debt faster.