No matter how digital we become, we will still have physical reward cards and credit cards, especially if you already had these items before the digital era. Knowing how to organize these items is key (affiliate) to your protection. Even if you have these items digitally, the physical items must be kept private and organized in a secure, locked space, which is vital these days, given the prevalence of identity theft. This post offers a great and easy way to manage unused reward cards and credit cards. Here are instructions on how to create a reward and credit card binder (affiliate) that can be stored in a fireproof safe (affiliate).

Jump to:

Why organize your credit cards and reward cards?

When these credit and reward cards are stolen, there is no easy way to contact the banks or stores unless you keep track of all the information on the back of the cards. This post will guide you on organizing these items and provide instructions on documenting the necessary backup information in case of an emergency or theft. Remember, this is all your personal information, and knowing where everything is and that it is secure will save you heartache and frustration in the future.

How to create a rewards/credit card binder

First, we will organize the physical cards you use frequently and those you don't.

Tools you need:

To create your own credit card and reward binder (affiliate), you will need the following items. Below are links from Amazon (affiliate) (affiliate).

- Business Card three-ring plastic holders: this one I selected has 25 sheets.

- Sticky Tabs - I used the ones from Avery labels.

- 1-thin binder - 1 inch works well. Avery binders are heavy-duty.

Sort your cards into the categories below.

Dividing the type of cards you have physically helps you find the information when you need it. I know this is very detailed, but you really do not need to do it this way unless you have several reward cards.

The first two categories are essential to have well-organized. The Reward Cards are not as important.

- Credit cards

- Misc. Cards - S.S. Cards, Passport services, voters' cards…

- Travel Reward cards

- Office reward cards

- Grocery Rewards cards

- Home reward cards

- Beauty reward cards

- Entertainment reward cards

- Clothing reward cards

- Pharmacy stores

- Office supplies reward stores

Or you can have only three categories: Credit Cards, Misc Cards, and Reward Cards from Store Categories.

Then, write one category on each sticky tab and affix it to the sheet that pertains to this category. See the image below.

Now that you have gathered all these cards and placed them in the corresponding categories, you can use the binder (affiliate) to keep them together and in order. Easy peasy!

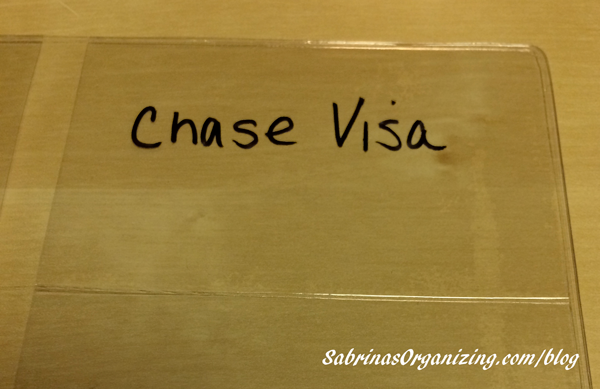

TIP: Write with a Sharpie (affiliate) marker on the business card plastic above each card, indicating which card goes in which slot. This way, if you or your partner pulls a card out, you'll know what's missing and can replace it in the correct spot. See the image below.

Create a checklist to keep in a safe place.

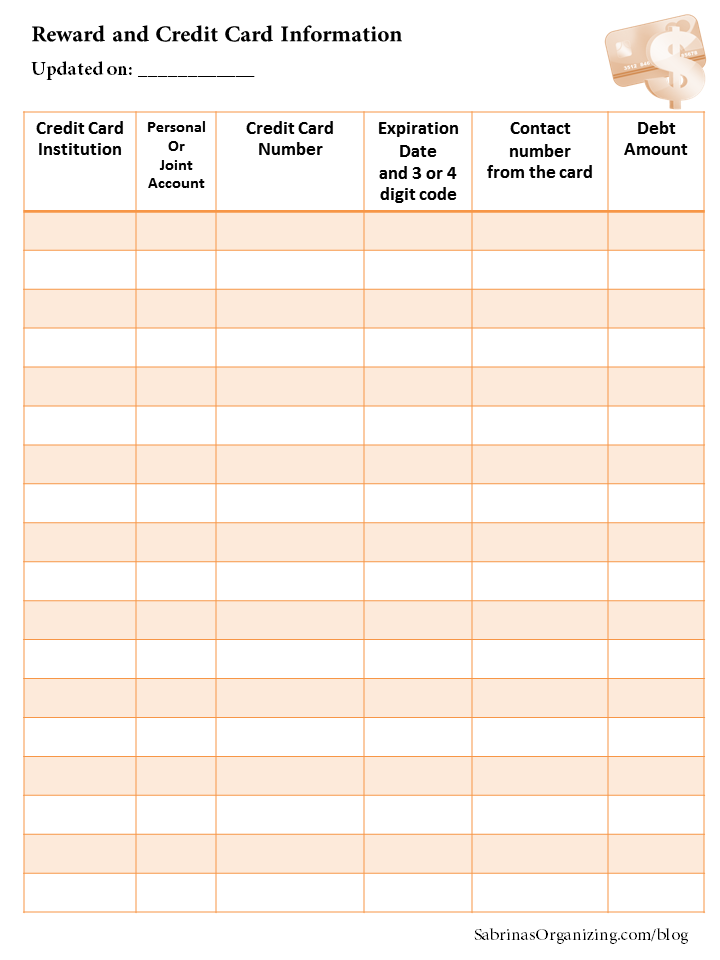

If you want to take it a step further, you can create a list of all the cards and include the following information on it.

- The name of the card

- Card account number,

- The expiration date,

- The three or 4-digit number on the card

- The phone number to contact

- And, if it is a credit card, you can add the card limit.

- If you are married, you can indicate if the card is a joint account or an individual card.

Then, you can store this in a separate location for backup. I suggest updating this sheet annually with any new cards issued to you. Fill in the information as described below.

Credit Card Tracking Sheet

Here is an example of what you can create to make your own reward and credit card checklist (affiliate) to complete and update when getting new cards or updating old ones. Store this checklist (affiliate) with your credit cards in a safe (affiliate) place as a backup.

Organize reward cards in an App.

If you like to collect your reward cards in an app, you can use an app like Key Ring to hold all your accounts.

If you want to use an app like LastPass, be sure to create categories so they are grouped. This is an app with a fee that will store all your digital login information, as well as other personal details. Nowadays, we should all be using a password management app. There are way too many passwords and pieces of information that we need to remember.

Revisit

Remember to revisit this credit card organization and update the checklist (affiliate) at least once a year, or whenever you need to make changes.

Keeping track of these cards will help you keep your private information secure and protected. How do you protect your credit card information? Let's start a conversation below.

Visit our other money management tips!

Leave a Reply