It's never too soon to work on organizing your finances. Before you know it, the holidays are here, and it's the new year. To help you get more organized with your finances, this post will break down the key (affiliate) areas and tasks you need to address to make your money work more effectively-no more working paycheck to paycheck. I know, it doesn't sound fun. Well, it isn't, but it is necessary to work on these areas. To help you get started, here are some places you should look at this month. I added some posts I wrote related to these areas. Feel free to click on them and read more.

Jump to:

- Review your Paying Bills System.

- Questions to ask yourself about your billing system:

- Review and write down how much you are saving.

- Answer these questions to figure out where you are saving money.

- Review your debt accounts and add them to a spreadsheet or money-management software.

- How to Track Your Expenses and Create a Budget - Part 1

- How to Track Your Money and Create a Budget - Part 2

- After you get all these debt accounts together, answer these questions:

- Go through your receipts (digital and/or physical).

- For Digital Receipts:

- For Physical Receipts:

- Supplies you need to organize paper receipts

- Gather all your important documents and credit cards.

- Best Fire-Proof Safes

- Closing Remarks

Review your Paying Bills System.

The first step in organizing your finances is to review your current bill payment process. Begin by ensuring your billing process is easy and streamlined. If you have some of your bill-paying process involving writing checks and the rest using autopay, you can consider using your bank's bill pay service to send out checks instead of writing them.

Questions to ask yourself about your billing system:

Is the billing system streamlined?

Do you have a bill pay area? Is it organized?

Can you work on getting some more payments on auto-pay?

Do you like how your system is now?

Is the system in place duplicating processes? Are you duplicating tasks, and do you need to do that?

Below are some additional posts that will help you with this process:

Seven Money Management Tips to Make this Year the Best!

WHAT TO KEEP IN YOUR BILL PAYING STATION

Review and write down how much you are saving.

The next step in organizing your money is to determine your savings. Visit the different accounts to find out where you are saving your money. This will include automatic transfers from your bank and automatic deposits from your paycheck or checking account. Also, check places like your 401K, Traditional IRA, or SEP-IRA.

Answer these questions to figure out where you are saving money.

How much liquid cash do I have right now? Liquid cash accounts are checking accounts, savings accounts, or money market accounts.

How much do I save for liquid cash?

What am I saving for Retirement, and is that enough for my age?

Am I saving money for future vacations or other activities?

Am I saving for a car or a new home? How much?

Review your debt accounts and add them to a spreadsheet or money-management software.

Now, it is time to gather all this information together in one place and determine your expenses to help you organize your money. Visit our recent posts about how to create a debt spreadsheet. In this section of our Home Maintenance ebook, you'll find a financial section that will help you become more aware of your debt and learn how to budget your money effectively.

How to Track Your Expenses and Create a Budget - Part 1

To be an adult means doing a lot of things you may not want to do. One of those things involves managing money. But where do you start? Years ago, I learned that tracking where you spend your money is essential.

After you get all these debt accounts together, answer these questions:

Do you have too much debt?

How should you bring down your debt?

Where do you want to focus first?

Go through your receipts (digital and/or physical).

It is important to review where you store your digital and physical receipts for your personal and business use. The business and personal receipt storage areas must be separate for easier access at tax time.

Review the paper and digital files and ensure each receipt/paid bill is in the right location.

Visit our How to Make a HOW LONG TO KEEP TAX RECORDS AND HOW TO ORGANIZE THEM post to learn how to make a tax record accordion folder.

For Digital Receipts:

If you place all your digital receipts in a folder marked 'Current Year Receipts,' you may find it challenging to locate items unless you label (affiliate) each file name with the company name and the month/year. Try labeling your digital receipts like this: "Verizon10-2025". Then, when you have an entire year of Verizon, you can easily see that you have all of them because each one will start with the name Verizon and end with the date and year. If you have a small business, visit our sister site, Sabrina's Admin Services, How to Make a Well-Organized Business Digital Receipt Organizer post.

For Physical Receipts:

Review your file folders (affiliate) for your receipts and ensure you only have the proper receipts in the current year's files. Removing older receipts will make it easy to find what you need for the current year. To learn more about how long to keep records, visit our post.

Usually, you can reuse the file folders (affiliate) by turning them inside out or relabeling them. Below are some of my favorite file folders (affiliate) available for purchase on Amazon (affiliate) (affiliate link).

Supplies you need to organize paper receipts

Pendaflex Portable File Box with File Rails in black

Buy Now →

Globe-Weis Poly File Folder Pockets, Letter Size, Assorted Colors

Buy Now →(affiliate)

Have a small business? Visit The Best Practices for Digital and Physical Filing Systems post ebook to help you get your business files organized.

If you like color coding your files, visit our HOW TO USE A COLOR CODING SYSTEM TO ORGANIZE YOUR HOME OR OFFICE post for guidelines.

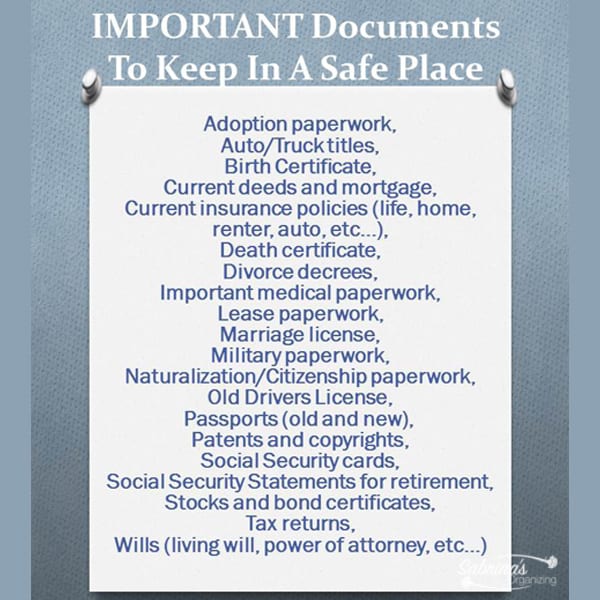

Gather all your important documents and credit cards.

The next area to organize is your credit cards, birth certificates, and Social Security cards. Any important document you have that you may need in the future. These items should all be in one or more fireproof safes. Visit my 'How to Organize Files in a Fireproof Safe' for guidance on setting this up. I also include a list of essential items. Visit our Create a Reward and Credit Card Binder for tips on how to make this binder (affiliate). Note not all safes will fit a binder (affiliate), but you can add the inserts to organize the cards and place them in a hanging folder in the fireproof safe (affiliate).

Best Fire-Proof Safes

Fireproof Document Box with Lock, File Organizer

Buy Now →

Fireproof Safe Box with Key Lock

Buy Now →(affiliate)

Important documents, such as wills, insurance policies, house deeds, and car ownership papers, are usually stored in filing cabinets, where they are likely to be found when reviewing receipts and paid bills. Pull them out of there and create a vital document file in your fireproof safe (affiliate).

Closing Remarks

I hope these money tips help you organize your finances and inspire you to get your money accounts in order. Now, get on with it and start this month! I recommend splitting the task over several weekends, not to overwhelm yourself. Did I miss any areas? Please feel free to leave a message below.

10