Many people have goals, and saving money is usually one of them. It could be creating a nest egg for retirement and saving for a new car or a house. Or just saving, so you don't have to live paycheck to paycheck. Whatever your reason is, make sure it is evident to you and the people you live with, because if everyone knows your goals, it helps you make them a reality and helps them realize what you are prioritizing in your life. So you don't need to be ashamed. You deserve to think about yourself for a change. So, I give you permission to go to the highest rooftops and share your goals with the world. Today, I am going to share with you my favorite ways to save money. Feel free to share it with others.

Jump to:

- Cut online services you may not be using.

- Find challenges to help you save money.

- Sell items in your home that are unused and in demand.

- Use reward cards, online coupons, and app coupons to save you money.

- Organizing your pantry and planning your meals will help you save on groceries each week.

- Share Entertaining Costs.

- Look for FREE Entertaining Activities.

- Quit habits that cost money.

- Start a budget

- Bring lunch every day.

- Ham and Cheese Calzone Recipe {Freezer Friendly}

- Easy Turkey Chili Recipe {Freezer Meal, Make Ahead, DF, GF}

- Brew Your Coffee

- Start Buying Generic Brands

- Reduce the Recurring Charges

- Subscribe

- And, lastly, reduce energy usage.

Cut online services you may not be using.

Go through your credit card and bank statements and find unused services you can cancel. Remember, it doesn't have to be forever. You can set it up again later after you reach your goal.

Find challenges to help you save money.

There are many "Saving Money Challenges" available online for you to choose from. Here are just a few I found from other bloggers. Look for challenges with printables so you can determine what you need to do each week.

52-Week Money Challenge by Rocket Money

Fidelity 52 Week Money Challenge

Check out my post about No Buy Challenge for guidance on how to set up this easy challenge for you.

Tip: Set up an auto-transfer for the amount you want to transfer and add it to your "Bills" in your money management software. Even though it is not a bill, think of it that way so you get into the habit of paying it every month.

Sell items in your home that are unused and in demand.

This task may not be the easiest thing to do, but it will help you in two ways: It will help you save money quicker, and it will reduce clutter in your home. It's a win-win. Don't you agree? Start by finding an item in your home and then search online to see what people have been buying. Try eBay or Craigslist. Be sure you are safe (affiliate), and never let anyone come to your home to buy something. Meet at a location that is familiar to you and bring someone with you just in case. You can even have a yard sale. This task will take some planning, however.

Use reward cards, online coupons, and app coupons to save you money.

There are numerous apps available that can help you save money. Some I like are my local grocery stores, Walmart's coupon website. Some years ago, I created a list of sites I would visit before going shopping to make sure I had all the coupons I could use. Did you know that some stores allow you to use two coupons on one purchase? Yes, it's true. You can use a manufacturer coupon and a store coupon on the same items. Please check your store's policies or ask the cashier for assistance.

Organizing your pantry and planning your meals will help you save on groceries each week.

We forget what we have when we can't see it. So make sure your pantry (affiliate) is organized with all the like items together. This task will help you quickly determine what you need and avoid buying duplicates unnecessarily. Feel free to visit my organizing your pantry posts to help you when you take on this task.

Below are some of my posts about meal planning.

HOW TO MAKE A MEAL PLANNING SYSTEM THAT WORKS

SPEED UP THE WEEKNIGHT COOKING CHALLENGE

Share Entertaining Costs.

If you're a social eater, consider inviting friends and family over for a potluck lunch. Everyone brings one dish, and each person can enjoy the meals of the others. If you'd like to reach out at lunchtime, try bagging a fun lunch for two and sharing it with a friend, which also helps them save money.

Look for FREE Entertaining Activities.

Kids entertain easily. Check your local paper for activities to take the kids. Or better yet, get your kids into nature. Find a hiking trail to take them when they just need to get out. Visit our low-cost date night tips post for a list of activities.

Quit habits that cost money.

Yes, I know you may not think drinking a wine glass a day isn't hitting your pocket. But it is. What about the cigarettes that you buy? How much do you spend on them? How often do you buy them? Even if you cut back on this habit a little at first, that will automatically help you save money. Do the math; you will see a difference in your savings right away.

Check out the Important Tasks to do to Organize Your Money post for more tips.

Start a budget

Everything has its price, and knowing how much comes in and goes out each month is key (affiliate) to managing your money and saving money as well. Creating a useful home management binder (affiliate) where you can write down everything from budget to chores is key (affiliate) to keeping everything running smoothly. For your convenience, I created a free ebook called "How to Make a Useful Home Management Binder." I also share the step-by-step instructions on how to make the binder itself in this "THE EASY WAY TO MAKE A DIY HOME MANAGEMENT BINDER FOR YOUR HOME" post. Spend some time gathering all the numbers together, which will help you identify the issues you have.

Bring lunch every day.

Buying lunch or dinner each day can quickly deplete your monthly budget. Instead, decide on five to seven recipes you can make and enjoy for lunch the next day. If you have a microwave at work, you are set. You can easily heat things there. If not, you can buy insulated containers that can stay warm for hours. My father, who was an electrician, would bring soup and bread to work in a coffee Thermos (affiliate).

Below are some freezer meals you can make and take to lunch with you the next day.

Brew Your Coffee

Buy your coffee for as little as $3.75 per 12-oz cup. If you do this for the entire year, you can save $615.00 per year. While there is a learning curve involved in making coffee that tastes good, a little time spent determining the best coffee to make will reveal that when you go out, the coffee you have been drinking is no longer outstanding. Check out this video about how to brew the best cup of coffee.

Start Buying Generic Brands

If you need a vitamin or take a medicine, choose the generic versions. If you buy groceries, select the store brand instead. Store brands are usually at least 10% or more cheaper than the other brands.

Downloading the apps for the pharmacies is another good way to save money. They usually run specials and have great deals on everyday items as well, and you can easily add them to your reward card.

If you have prescriptions, you may want to shop around for the best prices on these items. Consider using apps like GoodRx, SingleCare, or WebMDRx to compare pharmacies near you. This was an eye-opener for me.

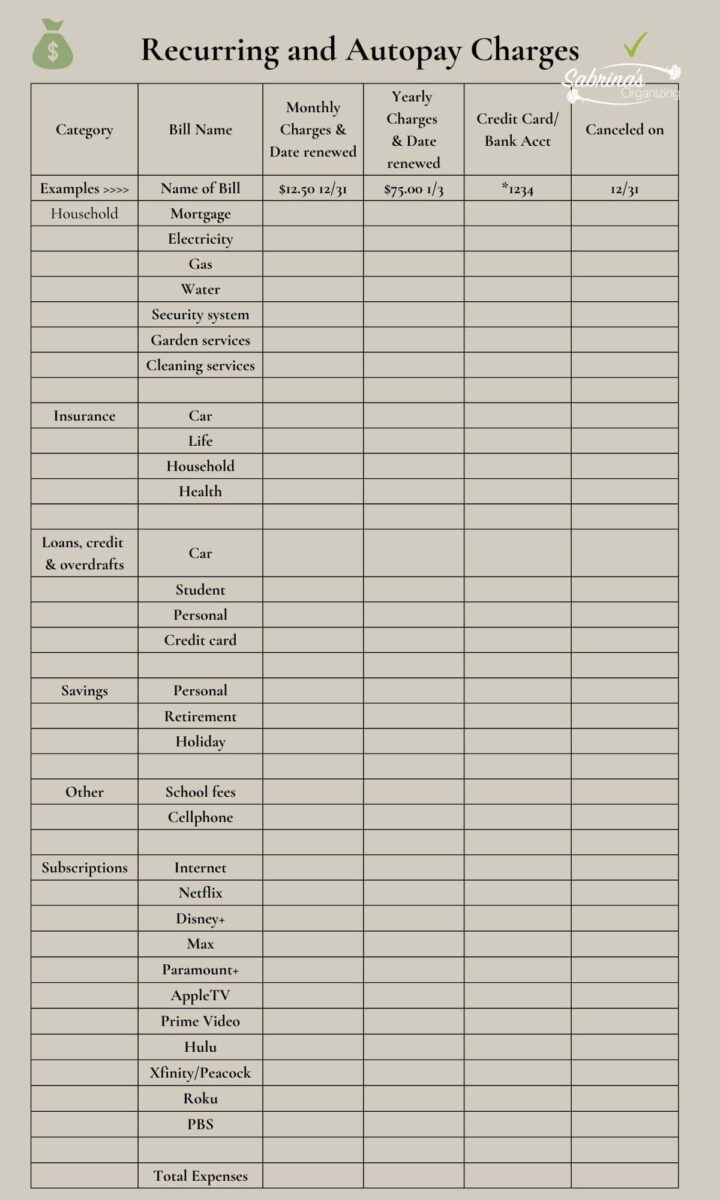

Reduce the Recurring Charges

Do you know where your recurring charges are and how much they are? Creating a list of these recurring charges, autopay charges, and the date they renew yearly or monthly. There can also be a column for whether you can cancel it to use later to reduce costs.

It's helpful to have a column that allows you to write the bank or credit card number on it (the last four digits work nicely) so you know which associated card or bank you used.

You should also track your recurring money charges somewhere as well. This can be added to your budget sheet, on a separate piece of paper, or in a file.

Feel free to get a free copy of the printable by signing up for my newsletter.

And, lastly, reduce energy usage.

Start by walking instead of driving. Try lowering your thermostat when you are not at home. Take shorter showers. Turn lights off and unplug appliances when they are not in use. All these little tasks will add to significant savings.

Well, there you have it. Hopefully, this gives you easy ways to save money. If you want, feel free to share the reason you want to save money this year below. I would love to hear about it. I hope you achieve your goals with little sacrifice.

Review more of our money management posts for more tips!

Kathy McEwan says

Great tips. The hardest one for me is the entertaining costs. I love to go out to eat and am getting tired of making dinners. I would love to have a good healthy meals delivered to me but that would cost a lot of money too. lol

Diane says

These are great tips, Sabrina. I forget that unplugging appliances helps to save on electricity. I always turn them off when not in use but forget the extra step.

Liana George says

We have cut our electric bill by going with a plan that offers us free electricity from 7 am- 10 am and 7 pm - 10 pm. That's when I run all my major appliances (washer, dryer, dishwasher, pool) and the savings has been incredible! Love this list and definitely sharing it with others!

Seana Turner says

As with so many aspects of life, I find it is the little things that have the greatest impact. A cup of coffee purchased at a retail establishment every day costs so much more than making it yourself. It doesn't seem like a lot of money on any given day, but run the math and it is easy to see.

Jamie Steele says

Meal planning has saved me a ton of money. I use an automated service called Real Plans and it automagically creates a meal plan for me. It has saved me so much time and money. I also love your point of canceling the automatic subscriptions. I really need to audit my account and see what I have signed up for that I may have forgotten about. In this day and age of the subscription service it can be hard to remember.

Sabrina Quairoli says

That's really cool, Jamie. I will have to check out Real Plans. We started meals delivery so I can get out of meal planning altogether. I will be writing our experience with two different meal delivery companies soon and how much we saved doing it this way. =) Thanks for sharing.

Daria says

Great practical tips Sabrina! I used to be really good about coupons when I received the newspaper each Sunday. But we weren't reading the paper and I hated just recycling it. Now I am terrible about coupons. I need to find online ones for groceries. If you have any you use, I'd love to know. Thanks!

Sabrina Quairoli says

Try Coupons.com, they have an app. Hope it helps.