Discussing money with aging parents can be a challenging conversation. This post shares tips and tricks to help make the topic more approachable to your parents. This is near and dear to my heart because, as parents get older, they are more likely to experience identity theft. It is a growing trend in this nation. Fifty or more individuals experience this more than ever before. To help combat this trend, let's talk about what information you should have to help your parents feel safer in their homes and with their money.

Jump to:

- Gather all the credit cards together and keep them in a safe place.

- Make a list of all the credit cards they have.

- Gather all the online financial login information and agent contact information.

- Make a list of all the bills your parents have.

- Gather all the essential documents that your parent may have around the house.

- Other tips to remember when having the money talk with your parents.

Gather all the credit cards together and keep them in a safe place.

The first money talk with aging parents is about what credit cards they have. They probably have many and may not be able to find them all. Using business card holders, add all the credit cards into it and store it in a safe (affiliate) deposit box or another fireproof safe (affiliate).

Make a list of all the credit cards they have.

Make a list of all their open accounts and paid-off accounts. This will help you understand where the money is and what to do with the accounts after they have been settled.

Gather all the online financial login information and agent contact information.

Store it in a safe (affiliate) place. Include information like the address, phone number, name of the agent, email address, login information, website address, etc... Any information that will help you get full access to their account if you ever need it. Be sure to update this sheet every six months or so.

If they are familiar with technology, check out LastPass or other online password apps to help them manage their passwords. You can easily get a family plan and share the password and other important information with your family members.

Make a list of all the bills your parents have.

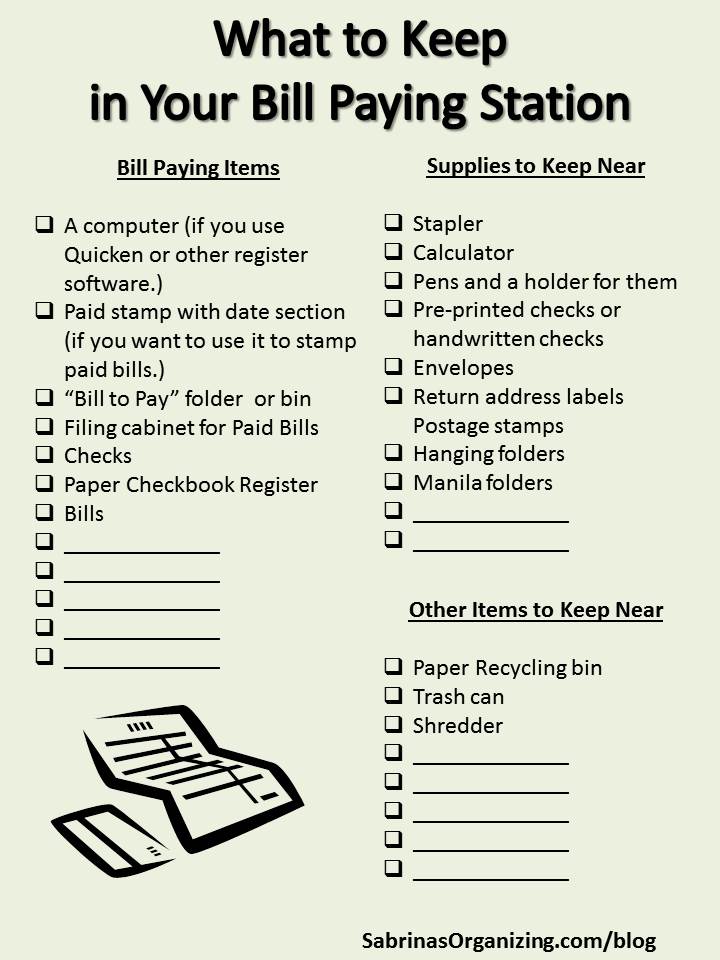

This will give you a better picture of the bills they are dealing with. I created a checklist (affiliate) to keep in your bill-paying station that will help you gather all the necessary items for paying your parents' bills or helping them stay organized. Check it out by clicking here.

The entire package to help you with hackers, viruses, malware, and ransomware provides up to $1M in potential coverage and so much more! *Note: rate is $47% off the first year! $189.99 / year. Protection for 10 PCs, Macs, Tablets, or Smartphones.

If they have not done a budget before or don't know where their money is going, check our free ebooks and posts on how to manage and track money.

HOW TO TRACK YOUR EXPENSES AND CREATE A BUDGET - PART 1

HOW TO TRACK YOUR MONEY AND CREATE A BUDGET - PART 2

The perfect solution for senior living! Customize labels for all your belongings and those of your family members, from clothing to a tablet.

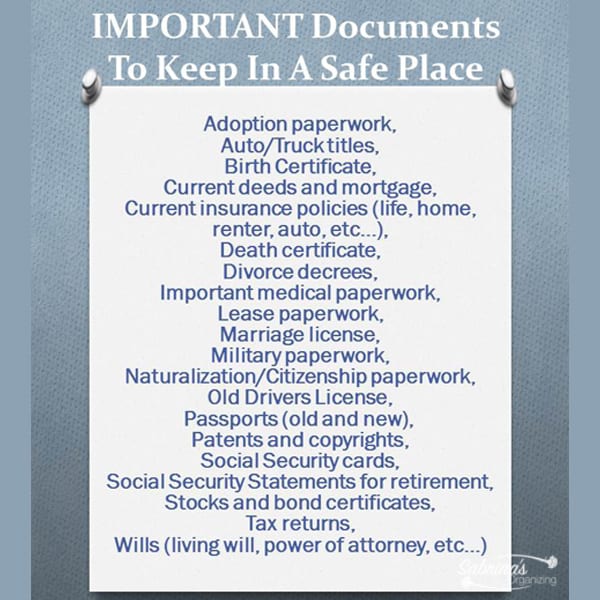

Gather all the essential documents that your parent may have around the house.

Here is a list of all of them. Click on the link below to visit the post about what to keep: Important Documents. It will give you a boatload of documents you will need to find in your parents' home.

Visit our post on organizing a fireproof safe for these important documents.

Other tips to remember when having the money talk with your parents.

Here are other tips below to help you through this process of gathering your parents' financial information:

Not all parents are willing to share this information with their children.

And that is OK. If they don't want to share this information with you, ensure they have a person you trust who can help you gather it. This person can be a financial advisor, a bookkeeper, or a family member. Stay calm if they resist sharing this information with you. Reacting to the resistance will only make the process even more frustrating.

Explain to your parents the different ways thieves can get their information.

Here is something I found from the FTC that discusses the various scams currently circulating. Feel free to click this link.

I hope this helps you and your parents stay safe (affiliate). Now it's your turn; what tips do you have for the readers that would help them with their parents' money matters? Please leave a comment below. I would love to hear from you.

The Complete Series:

Feel free to visit the rest of the posts in this series:

THE DOWNSIZING TALK WITH AGING PARENTS

TIPS TO HELP YOUR PARENTS DOWNSIZE THEIR STUFF

HELPING YOUR PARENTS WITH MONEY MATTERS <<<This post!

TIPS TO HELP YOUR PARENTS WITH PAPER MANAGEMENT

HELPING YOUR PARENTS WITH ONLINE ACCOUNTS

TIPS TO HELP YOUR PARENTS WITH LEGAL DOCUMENTS

Please note that these are affiliate links through Amazon (affiliate). At no additional cost to you, I will earn affiliate fees if you decide to make a purchase.

Visit our other money management posts for more tips.

Sarah Soboleski says

Money matters can be difficult to talk about, but I'm glad you included it in your series. Your checklists make it so easy to stay on top of things. Thanks for sharing your insights on such a sensitive topic, Sabrina.

Jill Robson says

Yes a very important conversation especially if you are dealing with older parents who are don't have their finances in order.

Seana Turner says

This is a great post, Sabrina. Important to share this out because it can be so overwhelming when you are managing emotions and health issues and all these details. This can be especially difficult when Mom and Dad have a complicated financial portfolio.

Andi Willis says

Great list, Sabrina! I would add determine which bills are automatically drafted like a cell phone. If someone passes or is I'll, they can still be charged for months before someone realizes what is going on. Something like a digital estate plan encapsulates a lot of what you talk about. https://goodlifephotosolutions.com/what-happens-to-photos-when-you-die/

Janet Barclay says

The worst example I've seen was when an elderly gentleman received a call from a young man claiming to be his grandson. He said he was in another city, had got in trouble, and needed money for a lawyer. Fortunately, he called his son to discuss it, and he assured him that his grandson was safe at home and that it was a scammer. I don't know whether he was more upset thinking that his grandson was in trouble or realizing he'd been targeted. The upside is that he's now more aware of such things, so the next time it happened, he just hung up.

Another older person I know received a call, supposedly from Canada Revenue, stating that he owed money and if he didn't pay he would be arrested. Fortunately, the clerk at the post office where he went to get a money order was on the ball and explained that it was a scam.

I guess the best thing we can do is to make sure they're aware of these scams and that they know they should never trust any stranger who calls them. The world is a very different place than the one they grew up in.

Sabrina says

Yes, I agree, Janet. Thanks for sharing these stories. It is one of the reasons I wanted to do this series. I have a few clients who are retired and they definitely are fearful of anyone. But, some may not be, my goals is to keep everyone, even seniors, informed.

Hazel Thornton says

My dad got the grandson call. Fortunately he was suspicious and didn't fall for it. But he did let someone access his computer to "fix" it once, giving them his credit card number. Yikes! He stopped payment soon enough, and deleted the software they had installed, and no lasting damage was done. Whew! We need to remember that even if they're savvy now, they may lose their sharpness as they get older.