I am a stickler for saving space. In our smaller home, space is a valuable commodity. So, to save storage space, one place I often visit is my long-term file storage area. In this area, I store all my paperwork for taxes and other support papers. And, if I forget or am too busy to spend time doing this, I find that this area can get disorganized rather quickly. So, I try each year to go through my long-term files. Recently, I decided to do just that and have documented all the tips/thoughts that went through my mind while doing this purging process. This post talks about organizing long-term files for personal and business use. I hope it helps you get inspired to get rid of your papers.

Tips to Organize Personal long term paper files

Jump to:

- Utility bills do not need to be kept unless you need them for home office expenses.

- Get rid of pay stubs as long as you have the W-2s with your taxes.

- Keep your taxes in an accordion folder with all the other tax-related papers.

- Reuse your manila folders.

- No hanging folders are necessary for long-term files.

- Use one bin that can hold at least two to three (or more) years to save space.

- Use a clear bin and label the years on the front.

- Shred letters that make you sad or angry.

- Shred ALL bills you don't want to keep!

- Have an easy-faceted receipts accordion folder.

- Tips to Organize Small Business Owners' long-term paper files

- Places to store your Organized Long Term Files

Utility bills do not need to be kept unless you need them for home office expenses.

You do not need to keep utility bills as long as they are paid, especially if you have online access to these accounts. Wait until you get the next bill before getting rid of them, though, just in case of issues.

Get rid of pay stubs as long as you have the W-2s with your taxes.

You do not need all your pay stubs at the end of each year since the totals show in your W-2. So, keep the last pay stub of the year, and when the W-2 comes in, make sure your numbers match.

Keep your taxes in an accordion folder with all the other tax-related papers.

Read more here about HOW LONG TO KEEP TAX RETURN SUPPORTING PAPERWORK. The accordion folders below are from Amazon (affiliate); feel free to buy them. (affiliate)

Accordion File Organizer with Handle,25 Pockets Portable

Buy Now →

Accordion File Organizer, 13 Pockets File Folders, Letter Size with Colored Tabs

Buy Now →(affiliate)

Reuse your manila folders.

Reuse USED manila folders by turning them inside out and using the unused inside tab to write the content. You can also use Manila folder labels (affiliate) to cover the previous labels (affiliate) in the folders. Pick the correct size file labels (affiliate) for your manila folder tabs (affiliate). They can vary from 2 inches to 5 inches. Amazon carries several sizes you can get the right one for you.

Disclosure: at no additional cost to you, if you click through and buy something on Amazon (affiliate), I will receive a small referral fee. Thank you for supporting my small business.

No hanging folders are necessary for long-term files.

Hanging folders are great for inside filing cabinets. They help when you want to subdivide a category. For instance, I have a hanging folder called "Utilities." I have all the household utility companies in manilla folders inside the hanging folder for easy access. At the end of the year, I pull the manilla folders and place them in long-term storage if I want to keep them.

Use one bin that can hold at least two to three (or more) years to save space.

The bin may be full, but it's just paper. Remember, space is valuable in any home, so fill it up. After three years, you can easily revisit these bins and remove unneeded papers.

Use a clear bin and label the years on the front.

Clear containers help you see quickly what is in them. The clear bins below are four-packs from Amazon (affiliate) (affiliate), or you can buy one. Click through if you want to get more details.

Buy Now →

Buy Now → (affiliate)

Shred letters that make you sad or angry.

Keeping memorabilia is nice, but keeping things that bring back memories of sad or angry times should be removed. If you want to revisit these times, please keep the papers.

Shred ALL bills you don't want to keep!

If you like printing e-bills, maybe you want to rethink this process. Instead, store the digital copy in a folder marked "bills." When downloading the file, write the name of the bill and the month the bill is for as the filename. Check out my complete instructions on downloading statements/receipts digitally and organizing them so you can access them easily on my post: How to Organize Digital Receipts in Your Home.

Have an easy-faceted receipts accordion folder.

If you keep receipts, have a covered receipts accordion folder (affiliate) so they don't fall out when you store them away. The items below are ones I found on Amazon (affiliate) (affiliate).

2 Pack 13-Pockets Expanding Accordion File Folder Mini Organizer Wallet

Buy Now →(affiliate)

Tips to Organize Small Business Owners' long-term paper files

This process is a little more complicated if you have a small business. Read below for additional tips to help keep your small business long-term papers organized.

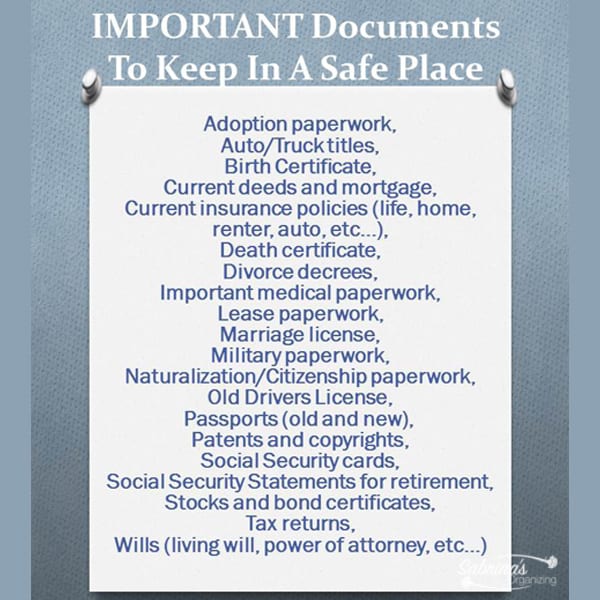

Keep business invoices and business receipts/expenses as proof for your returns.

Never throw away invoices for your business. You can, however, have them as PDFs stored in a safe (affiliate) place on your computer (affiliate). Don't use image files because if you ever have to, the printer (affiliate) will print them like a photo and use up a lot of your ink.

If you want to keep the receipts digital, check our extensive post: How to Organize Digital Receipts in Your Home.

Keep your bank and credit card statements for your business.

Banks only store bank statements for a maximum of 3-6 months. So keeping a copy helps if you ever need to reference them.

Keep files for your business in a folder with a faceted top.

Keep your files for the business in an accordion folder (affiliate) with a lid so they can be easily accessible and will not get mixed with personal papers. If using an accordion folder (affiliate), buy the ones with the cover. This lidded accordion folder (affiliate) will keep the documents in the box, and they won't get jostled around.

Keep your business paperwork separate from your personal paperwork.

Even if your business tax return is filed with your personal taxes, you should always keep the paperwork separated. It makes finding the papers you are looking for easier and quicker than going through unnecessary ones.

Places to store your Organized Long Term Files

Now that you have all these files organized, let's find a place to store them. There are several places in your home where you can store these files. It should be a place not used often but accessible when you need to go in the file bins. Here are some areas that may work for you.

Under the stairs is one good place for these files as long as they are in plastic bins (affiliate) to protect them from animals and water damage.

A closet is another good place to store these file bins. If you have them in sturdy plastic bins (affiliate), you can stack them up.

A storage locker - This is a great option for small homes, apartments, or tiny homes. If you use a storage locker, it will need to be climate-controlled to protect the papers from damp temperatures. You will also need to pay a monthly fee for this space. Ensure the locker has a secure lock to protect your private information.

Visit our sister blog (SabrinasAdminServices.com) about the business organizing long-term file posts below.

How Long Should I Keep Business Records

7 Areas to Organize Office Files

Benefits and Tips to Revisit Paper Files Yearly

I hope this helps you organize your long-term files. I was able to shred three bags of paperwork today. =) How many are you ready to destroy right now? Let's continue the conversation. Do you have any tips for organizing long-term paper files? Please leave a comment below.

Feel free to check out my other home office and paper management posts!

Home Office Posts!

Paper Management Posts!

Janet Schiesl says

Great tips for such an overwhelming topic. It's even harder these days to manage when some things are paper and some are digital and it feels like opportunity for things to be doubled up or lost.

Julie Bestry says

What a robust collection of advice. My favorite piece, though, has to be to get rid of papers that make you angry or sad. So many people hold onto such things out of a misplaced sense that throwing away a mean note or breakup letter absolves the writer of their unkindness. (Do hold onto anything that serves as legal proof of stalking or a violation of a restraining order; but you don't have to keep it where you can stumble across it. Box it up and send it to deepest storage!)

And I'm so glad you raised the issue of bank statements. Any institution that won't give you access to all of your data, in perpetuity, is requiring you to do the heavy lifting, so you may as well go digital. Great post!

Sabrina Quairoli says

Great advice, Julie. Thanks for sharing and commenting.

katherinemacey says

I agree with Julie on this one. Letting go of something that inspires negative emotions can be a great step toward healing from it!

Lisa Gessert says

Excellent paper management tips Sabrina, I love my paper clients and teaching them these great ways of handling their papers.

Sabrina Quairoli says

Thanks for stopping by and commenting, Lisa. =)

Janet Barclay says

You've got a ton of information here; I can't believe that's only 14 tips! I especially like the one about re-using USED file folders. There are many better ways to spend money!

Seana Turner says

I love that tip about turning manila folders inside out. We are in the process of sorting through some old paper (slowly!), and are keeping the used manila folders. I'll pass along this tip because it is really would make the files feel fresh and new if they were inside out.

Linda Samuels says

All great tips. When I began using Quicken to manage our business and personal finances it helped me simplify the paperwork. Since finding receipts or income is easily searchable on Quicjen, I can now file receipts by year in one file instead of subdividing.

My rule for keeping records as per my accountant is to keep the basic backup material for 7 years from date of filing. The tax returns get kept permanently. So each year after taxes are filed, we get to shred the “expired” files.

Sue says

How long are you supposed to keep statements, etc. for a small business?

How long for personal?

Sabrina says

Thanks for leaving a comment. For IRS purposes, you need to be able to show your income, so keep your invoices with your bank statements. Keep these items till the business is non-existent. Businesses are different than individuals. Since statements are a summary of the invoices, you do not need to keep them if you don't want to. Check this out for more details. Hope this helps.

Sabrina says

Sorry it took me so long to get back to you. Check with your accountant. They can help with this. Here is the link to the IRS page. https://www.irs.gov/Businesses/Small-Businesses-&-Self-Employed/How-long-should-I-keep-records. For personal, I suggest to use the same time frame as the small business link above says that way you are covered. Good luck.

Meredith @ The Palette Muse says

These are great tips. I always find that my short term storage becomes my long term storage before I know it. I need to go through the last few years' files and weed out all the stuff I don't need anymore. Thanks for the inspiration!

Pamela Chollet says

Ohh Ohh I hate filing! I always wind up with 50 more sub-categories than I need. My biggest problem is I don't start what I finish because I get overwhelmed by the amount of paper. Right now, I'm debating about hiring a professional organizer to help with the sea of folders I've accumulated. I think I could burn down Rome with what I have in boxes.

Sabrina says

Taking it small works best when you get overwhelmed easily. Also, try to keep your emotions out of it. Remember it is just paper. Before starting create a list of general categories you want to sort into. Then, when you go through the paper, if you see another category come about you can split out the exist smaller pile easily. I think it is a good idea to get help from a P.O. They can create an easier filing system to streamline your process which will help you maintain the system. Good luck!

Mina Joshi says

I hate filing and end up having bills, receipts, letters etc. all over the place. Every so often - I have a tidy up and shred a lot of stuff but I really need to take a day off just to file stuff neatly.

Sabrina says

Mina,

I like to shred while watching TV. It works great and I feel like I am not wasting time watching TV. =)

Marquita Herald says

Excellent tips and I also am BIG on saving space, and saving as many trees as possible. I live on a small Island and am all too aware of our landfill and refuse issues so almost all of my documents are digital and I recycle everything I possibly can.

Sabrina says

Great job Marquita! I have friends that live on an island and when we went to visit years ago, I learned a lot of ways to generate less waste, like cutting up a small tablecloth into small squares, sewing the ends so they don't fray and using the as cloth napkins for everyday. It worked well.

William Rusho says

Great tips this week. This is something I truly need to implement in my life. My paperwork is all over the place, from drawers in my office, to my glove compartment in my car. Thank you for sharing this.

Sabrina says

Thanks for stopping by William!

Beth Niebuhr says

One big space saver that I can do right away is to get rid of those utility bills! Yay! I never even thought of that. I like the idea of using acordian files; great idea.

andleeb says

I follow few of the tips that you have listed to organize files etc. I will try to follow more as I have recently moved to a small house and still I am struggling with organizing my files etc. I hope these tips will help me.

Lenie says

i pretty well do as you listed other than the time of year. I keep a large manilla envelope for our taxes and as I clean up the files at the end of the year, I put all my tax information in the envelope - then I just need to add the Jan/Feb. stuff. Anything outdated and no longer needed gets shredded. Good suggestions.

Erica says

Gosh, just reading about organizing for business makes me tense. I hate organizing. Having said that, you have some really good advice. I love your tip to shred letters that make you sad or angry. Such common sense, but so many of us hold on to things that hurt us. Ok, now that I'm thinking about this I think I'll go organize my receipt file for my business this year tomorrow!

Sabrina says

Good for you Erica! That's wonderful. Paper management makes everyone so crazy. Think of it like a puzzle (it's challenging but not impossible), you just need to find the pieces that fit and then you are good to move on to something else. =)

Donna Janke says

I already do most of this for organizing files, but I haven't always. I had a lot of my old papers and old papers from my parents (who've been dead more than 10 years). Over the past 2 years as we prepared to downsize, we sorted through and got rid of anything but the essentials. We took several boxes to a shredding company. We now make regular use of our own shredder. It's surprising how much paper there still is in what was to become a paperless society!

Sabrina says

That's wonderful, Donna! I have both of my parent's estates papers and have been reducing a little at a time to 1 box each (I am keeping just the estate paperwork). I tend to be conservative so I wait 7 years to reduce their paperwork. Having downsizing as a goal makes it so much easier to get rid of stuff, especially paper. Great job.

Catarina says

Since I already do what you suggest, Sabrina, I naturally believe your suggestions for organizing long term files are great.

Sabrina says

Thanks for stopping by Catarina! Organizing long term files and not keeping too much is so important.